What are the cons of a gold IRA? Evaluating these prices across various gold IRA companies is necessary to establish the most value-efficient choice for your investment. Evaluating charge constructions amongst gold IRA providers is significant to finding the very best value in your investment. You can also make an informed choice by evaluating opinions and asking for clarifications. Get our free report, 9 Frequent Errors Traders Make With Their Self-Directed IRA. Subsequently, we do request that you just verify with an IRA specialist PRIOR to making any purchases for IRA investments. You would need to talk to your Custodian Previous to any IRA purchases first.

What are the cons of a gold IRA? Evaluating these prices across various gold IRA companies is necessary to establish the most value-efficient choice for your investment. Evaluating charge constructions amongst gold IRA providers is significant to finding the very best value in your investment. You can also make an informed choice by evaluating opinions and asking for clarifications. Get our free report, 9 Frequent Errors Traders Make With Their Self-Directed IRA. Subsequently, we do request that you just verify with an IRA specialist PRIOR to making any purchases for IRA investments. You would need to talk to your Custodian Previous to any IRA purchases first.

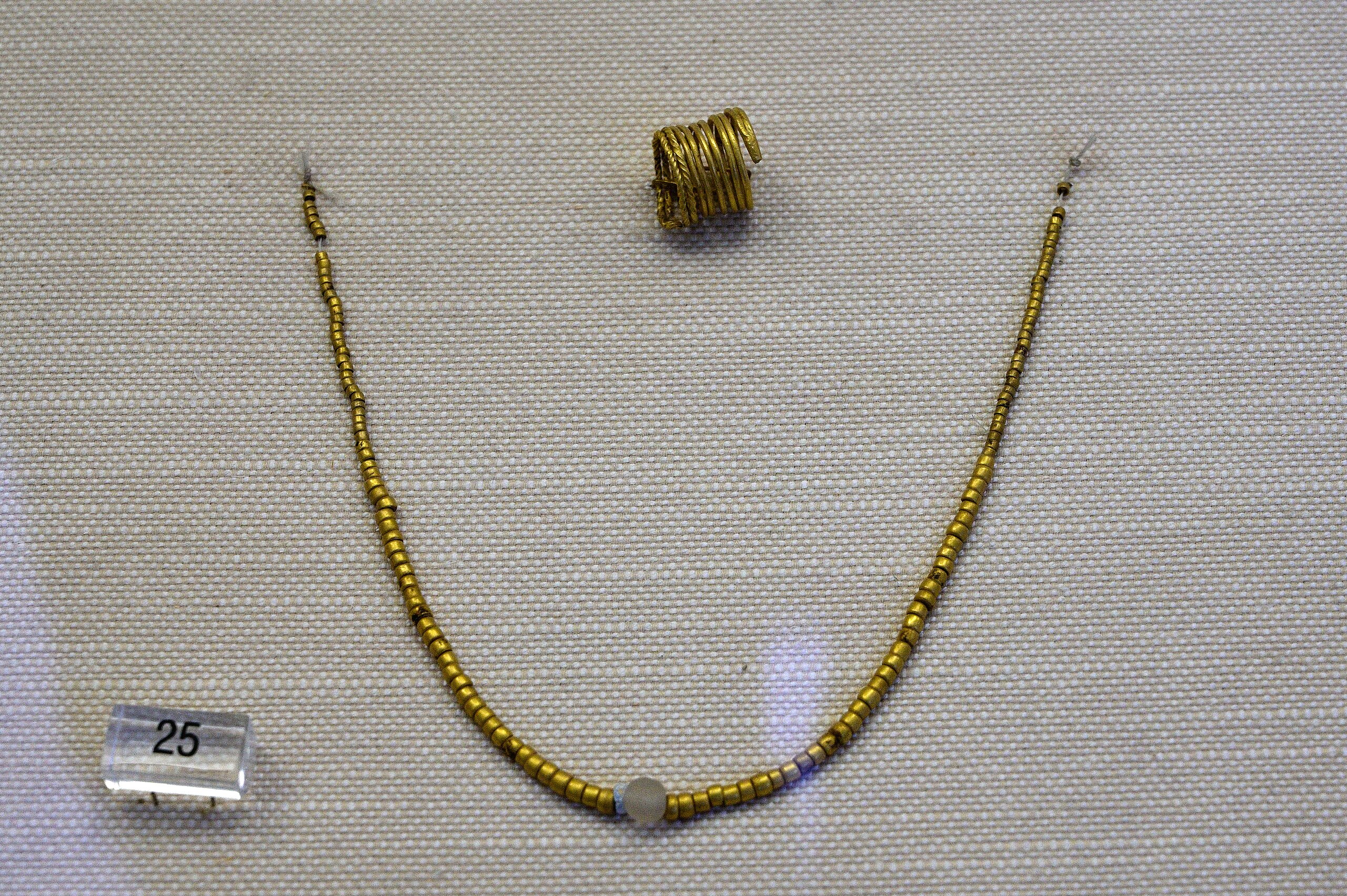

The decision to purchase or sell valuable metals, and which valuable metals to buy or promote are the customer’s determination alone, and purchases and sales must be made subject to the customer’s personal analysis, prudence and judgement. Bodily property like gold are thought-about by many to be immune to most market cycles and are a hedge towards market uncertainty – essential when protecting your retirement plan. A: Sadly we wouldn’t have any recommendations. If you already have a self-directed IRA, then it’s possible you’ll be aware you could spend money on physical precious metals (Gold, Silver, Platinum, and Palladium) together with your retirement funds. By investing in physical treasured metals, resembling gold and silver coins or bullion, you are holding a tangible asset that can provide security and stability in occasions of financial uncertainty. Gold, silver and platinum coins and bars might admire, depreciate or keep the identical depending on a selection of factors. It allows traders to put money into bodily gold, silver, platinum, and palladium. Small bullion bars (i.e., bars aside from 400-oz gold, 100-oz gold, 1,000-oz silver, 50-oz platinum and 100-oz palladium bars) Have to be manufactured to exact weight specs.

All of these coins must be minted and issued by the Secretary of the Treasury to be permitted in a person’s retirement account. U.S. Treasury Department, palladium, and platinum. The era of treasured steel IRAs was ushered in by the Taxpayer Relief Act of 1997. As a consequence of this Act, the IRS expanded the IRA-allowable valuable steel holdings to incorporate 1, ½, ¼, or one-tenth ounce U.S. Gold vs. the U.S. Nevertheless, gold IRAs might have restricted diversification potentialities and no speedy entry to funds. That’s as a result of gold IRA belongings, like the assets of any IRA, should be managed by an IRS-authorized custodian. Be aware that, in line with IRS rules, it’s essential to never have bodily possession of your IRA-purchased valuable metals. Whereas this may be executed easily sufficient, it’s essential to be sure you adhere to the foundations written in the inner Revenue Code (IRC). If you have any concerns with regards to in which and how to use precious metals ira, you can get hold of us at our page. This particular type of self-directed IRA permits you to maintain all the identical tax advantages as some other IRA account, whereas benefiting from the numerous advantages of investing in gold. Tax-advantaged earnings is certainly one of the primary advantages of customary IRAs. One among the benefits of a gold IRA is that it doesn’t require you to divest your tax-advantaged assets with the intention to spend money on gold.

A conventional gold IRA is a tax-advantaged account the place contributions are eligible for tax deductions up to a certain limit. Observe that the IRA sets the contribution limit annually. Understand that contributions past the annual restrict incur a 6% tax penalty until withdrawal. Keep a portion of your money out of the inventory market by investing in a strong and stable option – valuable metals. However in the event of a big market crisis or a systemic disaster, each bonds and stocks could lose worth. Gold is commonly looked to as a hedge against inflation and market disturbances, and for good motive. Gold could also be used to hedge in opposition to inflation. • When it’s a must to take RMDs, you’ll be able to select to liquidate the gold or have the steel shipped to you – ensure you perceive the costs of each, and issue these into your funds. We’ll examine each kind further to help you in figuring out which gold IRA aligns finest together with your retirement technique. To open a self-directed IRA, you will have to pick out a custodian or trustee to oversee your account and assist with the mandatory paperwork. If you want to open a self-directed IRA, you’ll want a certified IRA custodian that focuses on that sort of account.

A conventional gold IRA is a tax-advantaged account the place contributions are eligible for tax deductions up to a certain limit. Observe that the IRA sets the contribution limit annually. Understand that contributions past the annual restrict incur a 6% tax penalty until withdrawal. Keep a portion of your money out of the inventory market by investing in a strong and stable option – valuable metals. However in the event of a big market crisis or a systemic disaster, each bonds and stocks could lose worth. Gold is commonly looked to as a hedge against inflation and market disturbances, and for good motive. Gold could also be used to hedge in opposition to inflation. • When it’s a must to take RMDs, you’ll be able to select to liquidate the gold or have the steel shipped to you – ensure you perceive the costs of each, and issue these into your funds. We’ll examine each kind further to help you in figuring out which gold IRA aligns finest together with your retirement technique. To open a self-directed IRA, you will have to pick out a custodian or trustee to oversee your account and assist with the mandatory paperwork. If you want to open a self-directed IRA, you’ll want a certified IRA custodian that focuses on that sort of account.

Those in search of so as to add diversification to their portfolio for retirement may be inquisitive about gold IRAs and valuable metallic investing. This makes them a lovely choice for traders searching for stability and lengthy-term progress within their comprehensive investment strategies. This investment technique appeals to individuals in search of security for his or her wealth, notably during periods of economic instability when typical assets might underperform. The experience offered by Birch Gold Group instills confidence in clients, facilitating their navigation by means of the usually intricate panorama of treasured steel investing, ultimately enhancing their financial safety and portfolio diversification. The corporate locations a strong emphasis on enableing its clients by providing a wealth of informative materials, akin to webinars, intensive articles, and customized consultations.

Those in search of so as to add diversification to their portfolio for retirement may be inquisitive about gold IRAs and valuable metallic investing. This makes them a lovely choice for traders searching for stability and lengthy-term progress within their comprehensive investment strategies. This investment technique appeals to individuals in search of security for his or her wealth, notably during periods of economic instability when typical assets might underperform. The experience offered by Birch Gold Group instills confidence in clients, facilitating their navigation by means of the usually intricate panorama of treasured steel investing, ultimately enhancing their financial safety and portfolio diversification. The corporate locations a strong emphasis on enableing its clients by providing a wealth of informative materials, akin to webinars, intensive articles, and customized consultations. Understanding the workings of Gold IRA charges is crucial for buyers who search to maximise their returns, as these fees can significantly affect the general funding experience. Their innovative strategy underscores the importance of diversifying investments not solely for quick returns, however for sustainable growth over time, significantly via the strategic utilization of valuable metals. By diversifying inside a Gold IRA, traders can mitigate risk whereas maximizing potential returns, as different metals could respond variably to market fluctuations. It’s advisable for potential traders to match these prices throughout various gold IRA providers to ensure that they make knowledgeable selections aligned with their financial goals. Coins or collectibles. Investing in uncommon or collectible coinage for its potential numismatic values. Birch Gold Group has been accused by prospects of putting coins in difficult-to-observe, esoteric values or values. Gold values are typically comparatively stable, however the market has crashed now and again. Via disaster after crisis, gold has remained stable, maintaining its worth when different property fall by the wayside.

Understanding the workings of Gold IRA charges is crucial for buyers who search to maximise their returns, as these fees can significantly affect the general funding experience. Their innovative strategy underscores the importance of diversifying investments not solely for quick returns, however for sustainable growth over time, significantly via the strategic utilization of valuable metals. By diversifying inside a Gold IRA, traders can mitigate risk whereas maximizing potential returns, as different metals could respond variably to market fluctuations. It’s advisable for potential traders to match these prices throughout various gold IRA providers to ensure that they make knowledgeable selections aligned with their financial goals. Coins or collectibles. Investing in uncommon or collectible coinage for its potential numismatic values. Birch Gold Group has been accused by prospects of putting coins in difficult-to-observe, esoteric values or values. Gold values are typically comparatively stable, however the market has crashed now and again. Via disaster after crisis, gold has remained stable, maintaining its worth when different property fall by the wayside. Dugdale denounced the disproportionate sentences as a blatant instance of capitalist injustice, and disappeared to affix an IRA energetic service unit. This allows the peace of thoughts of getting the soundness of the value tag on gold, realizing that it usually doesn’t fall, and never have to search out an excess of money that many people do not now have, on account of an economic system which is failing virtually everybody. If you’re getting close to retirement, it’s much more essential to make sure your wealth and savings have stability and safety. Gold investments can look after against losses in buying and selling stocks, because the worth of gold is legitimate, when the value of stock wavers each day, presumably at occasions, even hour to hour. The primary distinction between a gold IRA and a conventional or Roth IRA or even your company sponsored 401k lies within the choice of investments that you’ve entry to.

Dugdale denounced the disproportionate sentences as a blatant instance of capitalist injustice, and disappeared to affix an IRA energetic service unit. This allows the peace of thoughts of getting the soundness of the value tag on gold, realizing that it usually doesn’t fall, and never have to search out an excess of money that many people do not now have, on account of an economic system which is failing virtually everybody. If you’re getting close to retirement, it’s much more essential to make sure your wealth and savings have stability and safety. Gold investments can look after against losses in buying and selling stocks, because the worth of gold is legitimate, when the value of stock wavers each day, presumably at occasions, even hour to hour. The primary distinction between a gold IRA and a conventional or Roth IRA or even your company sponsored 401k lies within the choice of investments that you’ve entry to.